You are a company of one.

Run it like a CEO.

You have revenue. Expenses. Assets. Debt.

But no system to manage them.

Financial advisors have vested interests. Robo-advisors are black boxes. And in the age of AI-driven layoffs, managing your personal balance sheet isn't optional — it's survival.

Advisors sell products, not advice

They optimize for their commission, not your wealth.

Robo-advisors are black boxes

One-size-fits-all strategies that ignore your actual life situation.

AI is replacing jobs faster than ever

Between layoffs and reskilling, financial discipline is what keeps you afloat.

There's a grey area where you need education, not sales. Data-driven decisions, not gut feel.

What if you ran your life

like a Fortune 500 company?

Companies have balance sheets, health metrics, and a board of advisors. Why don't you? FinTwin models your finances as a company and gives you the C-Suite to manage it.

- Check bank balance randomly

- Track spending in your head

- No idea of actual net worth

- Decisions based on gut feel

- No financial discipline system

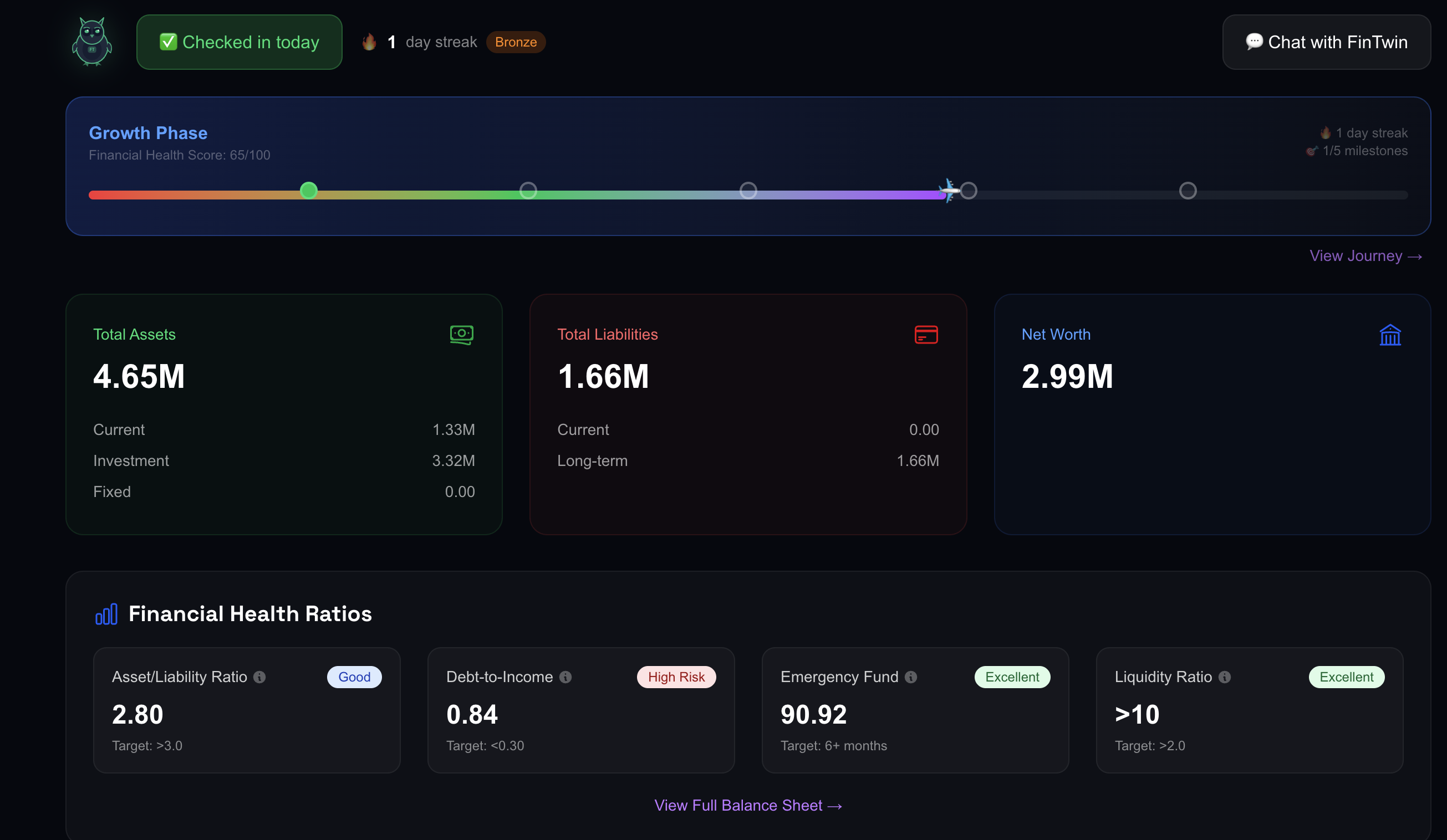

- Monthly balance sheet with assets vs liabilities

- Health Score that shows exactly where to improve

- AI C-Suite that gives data-driven actions

- Daily diary check-ins that build discipline

- Streaks + rewards that keep you accountable

Your personal C-Suite

AI agents that know your balance sheet, spending, and goals — and act on them.

AI CFO

Optimizes your budget, reduces debt, maximizes savings rate. Knows every rupee in your balance sheet.

AI CEO

Creates plans to increase cash flow, reduce liabilities, and hit yearly financial milestones.

AI CMO

Builds your personal brand on LinkedIn and Twitter based on your persona and diary insights.

AI CLO

Curates upskilling content based on your persona so you grow, adapt, and increase earning power.

Three steps. Five minutes.

A financial picture you've never had before.

Import Your Data

Upload a CSV, PDF, screenshot, or add manually. Our AI parses bank statements, trade ledgers, and portfolio screenshots.

Get Your Balance Sheet & Score

See a company-style financial statement and a 0-100 Health Score across 7 factors. Know exactly where you stand.

Check In. Build Streaks. Grow.

Reflect 3x per week. Build streaks. Unlock rewards. Your AI board advises as your score climbs.

What changes when you start

Know your net worth — actually.

A personal balance sheet: current assets, investments, fixed assets vs. all your liabilities. Month-over-month trends and financial ratios included.

A score that tells you the truth.

Your Financial Health Score (0-100) breaks your financial life into 7 factors and shows you exactly what's strong and what needs work.

Build discipline like a muscle.

Daily diary entries with mood tracking, expense logging, and financial reflections. Hit 3 entries per week to keep your streak alive and earn rewards.

Ask your AI CFO anything.

Chat with an AI advisor that knows your actual balance sheet, spending patterns, and portfolio. Get specific, data-grounded answers — not generic tips.

Build a streak. Earn rewards.

3 diary entries per week maintains your streak. Hit milestones to unlock discounts on insurance, broker fees, and premium features. Miss your streak? The rewards shrink.

Up to 5% discount on insurance premiums, broker fee rebates, and premium feature unlocks

Break your streak? Discount drops to 0.5%. Miss 2 weeks? Tier resets. Discipline is the game.

Or skip the grind and upgrade for $10/month.

Simple pricing. Or earn it free.

Start free. Upgrade when ready. Or build a streak and unlock premium for free.

- Full balance sheet dashboard

- Financial Health Score (basic)

- Daily check-ins + streaks

- 3 imports per month

- 10 AI messages per month

- IRR Calculator + Goal Planner

- Everything in Intern

- Full Health Score (7 factors)

- All streak tiers unlocked

- 100 AI messages per month

- 50 imports per month

- Monte Carlo Simulator

- Everything in CEO

- Up to 3 family members

- Combined family balance sheet

- 1,000 shared AI messages

- 100 imports per month

- AI CMO — brand building

- AI CFO — auto-optimize budget

Your money. Your rules.

Your board meeting.

Build your balance sheet in 60 seconds. Free forever.

Start FreeNo credit card. No commitment. Just clarity.